why do all cryptocurrencies rise and fall together

Why do all cryptocurrencies rise and fall together

Some examples of digital currencies include cryptocurrencies, stablecoins, and Central Bank Digital Currencies. Interestingly, CBDCs are a common highlight in every digital currency vs cryptocurrency comparison as they are the most credible form of digital currency https://generoustroopers.com/. CBDCs are a type of digital currency issued by the government or national monetary authority of a country.

Unlike other cryptocurrencies, stablecoins are pegged to an asset, such as the U.S. dollar or the euro. And because a stablecoin tracks the pegged asset, its value stays stable relative to the pegged asset. Of course, some stablecoins aren’t pegged to a hard asset and instead maintain stable value by technical means, such as destroying some of the currency supply to generate scarcity. Those are known as algorithmic stablecoins.

This post will explore some of the differences between opposing cryptos. Whether a person prefers Bitcoin, Ethereum, or some other crypto whose name very few people recognize, it is wise to know how that particular cryptocurrency works to avoid being caught off guard.

Digital currencies are better than physical currencies as it is difficult to forge them. Physical currencies might have different unique features, such as watermarks and optically variable ink. However, these features don’t make physical currencies invulnerable to counterfeiting. On top of that, digital currencies also offer more efficient, secure, and instantaneous transactions. You can also use digital currencies to make faster and easier cross-border payments without paying hefty transaction fees.

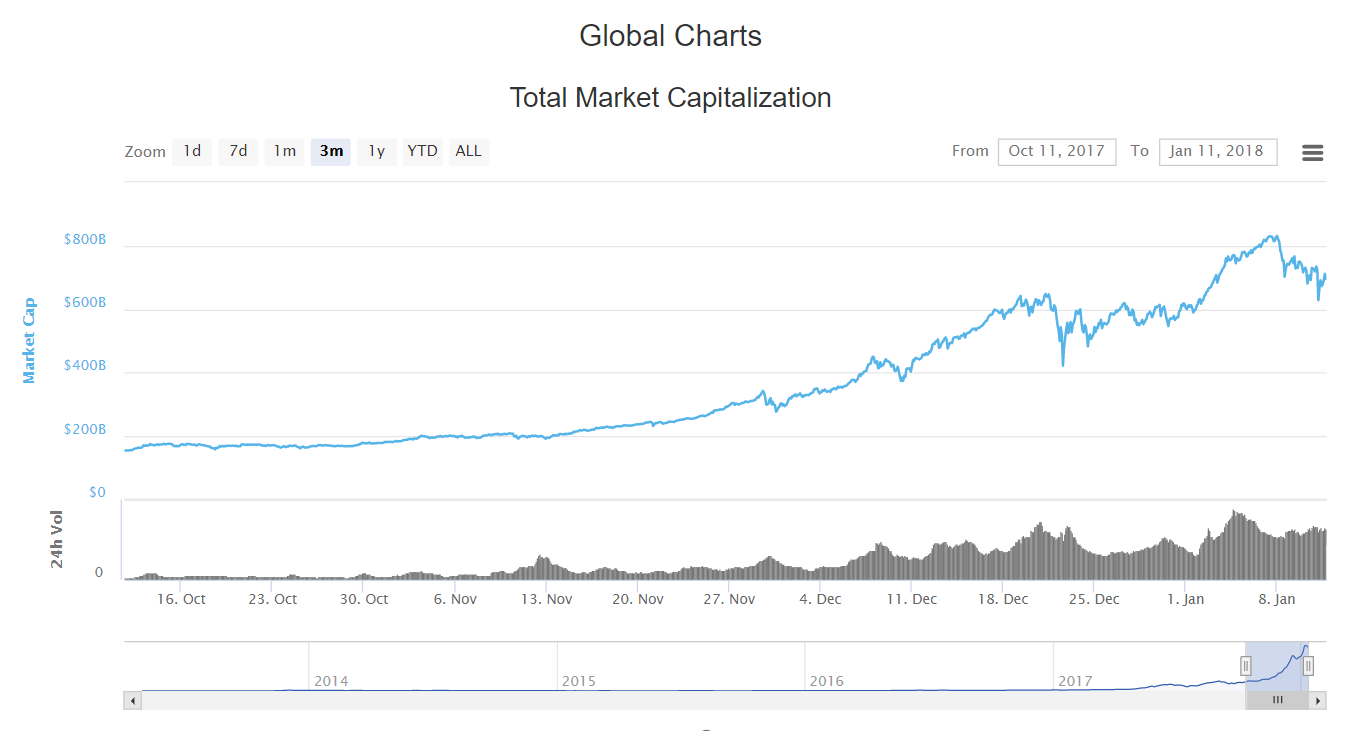

Market cap of all cryptocurrencies

A stablecoin is a crypto asset that maintains a stable value regardless of market conditions. This is most commonly achieved by pegging the stablecoin to a specific fiat currency such as the US dollar. Stablecoins are useful because they can still be transacted on blockchain networks while avoiding the price volatility of “normal” cryptocurrencies such as Bitcoin and Ethereum. Outside of stablecoins, cryptocurrency prices can change rapidly, and it’s not uncommon to see the crypto market gain or lose more than 10% in a single day.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

A stablecoin is a crypto asset that maintains a stable value regardless of market conditions. This is most commonly achieved by pegging the stablecoin to a specific fiat currency such as the US dollar. Stablecoins are useful because they can still be transacted on blockchain networks while avoiding the price volatility of “normal” cryptocurrencies such as Bitcoin and Ethereum. Outside of stablecoins, cryptocurrency prices can change rapidly, and it’s not uncommon to see the crypto market gain or lose more than 10% in a single day.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

All casinos accepting cryptocurrencies

This development ensures that fairness of games becomes provable, as it makes manipulating the outcomes in any way impossible. Sometimes, the term ‘Provably Fair’ is used as a label to exemplify this. In the future, when this sort of technology becomes more widespread, it will allow players to engage with online casino games with more confidence and ease.

Casino.guru is an independent source of information about online casinos and online casino games, not controlled by any gambling operator. All our reviews and guides are created honestly, according to the best knowledge and judgement of the members of our independent expert team; however, they are intended for informative purposes only and should not be construed as, nor relied upon as, legal advice. You should always make sure that you meet all regulatory requirements before playing in any selected casino. Copyright ©2025

Our team reviewed the best crypto casinos online to summarise the most preferred cryptocurrencies. Keep on reading to find out if your preferred crypto falls under the radar of the best Bitcoin online casinos.

Most people default to Bitcoin when playing at crypto casinos, but there are many other options out there, each with their own pros and cons. For example, you might prefer the faster payout time of Solana or the more stable value of Tether or USD Coin.

No Comments